Relative Price and Value of pre-Phase III (‘Hidden’) Pipelines for the 22 Largest Drug & Biotech Companies

We believe pre-phase III (i.e. ‘hidden’) pipelines are misvalued for a very simple reason: they’re hidden. However because companies’ patenting behaviors are consistent and complete (and begin at early stages of discovery), patent data allow us to see what’s otherwise hidden, and to determine whether it’s fairly valued

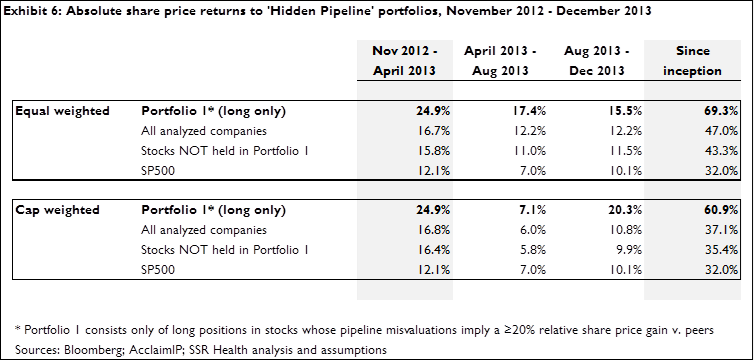

The percent of share price explained by a company’s hidden pipeline ranges from less than 10, to more than 50 percent (average +/- 31 percent). The apparent value of innovation in these companies’ hidden pipelines spans a similarly broad range, but in many cases the capitalization of a company’s pipeline will be low v. peers’ even though the apparent value of its pipeline is high v. peers’, or vice versa. For example (redacted) offers more than 4x as much hidden pipeline innovation per dollar of capitalization than peers on average; whereas (redacted) offers about half as much

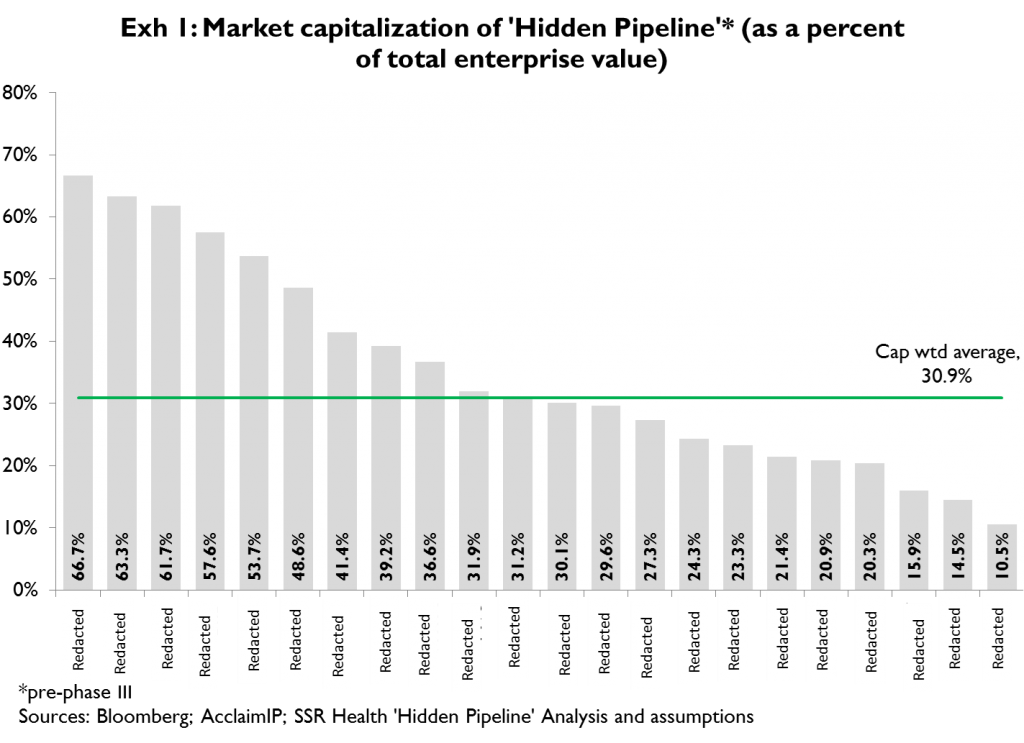

Because hidden pipelines account for a large percentage of stock price, and because hidden pipeline valuations are less certain (i.e. more volatile) than other components of share price, hidden pipeline misvaluations should heavily influence relative performance. Since inception in November of 2012, our portfolio of stocks with undervalued hidden pipelines has outperformed peers by more than 1.5x

Because of large misvaluations in hidden pipelines, shares of (redacted) all appear at least 20 percent undervalued. Conversely shares of (redacted) all appear at least 20 percent overvalued

Premise and rationale

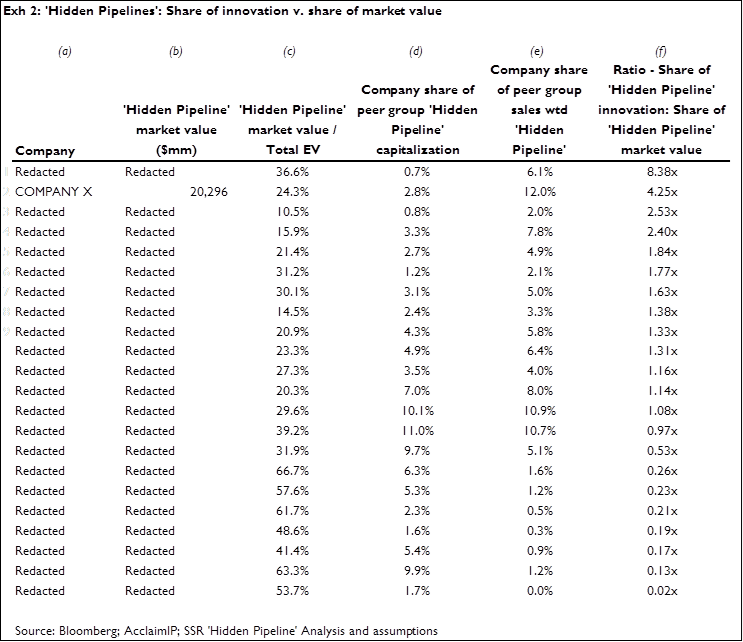

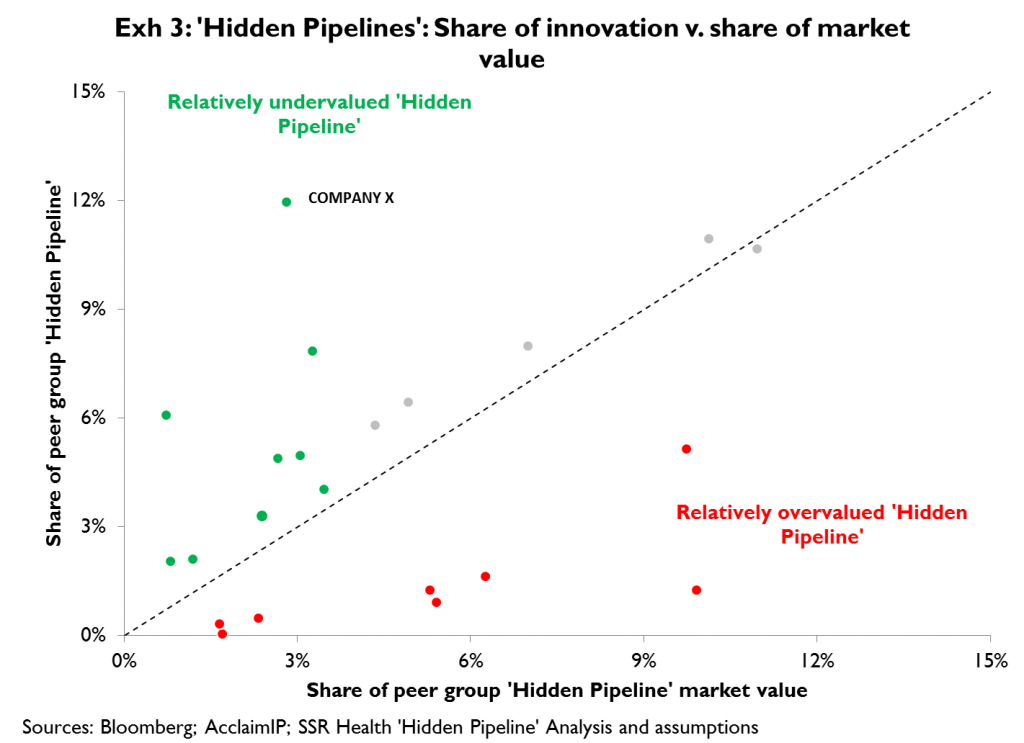

Share prices of drug and biotech stocks arguably can be broken down into two major components: the capital markets’ estimates of the value of assets that are well characterized (i.e. on-market, filed, and late-stage developmental projects), plus the markets’ estimates of the value of assets about which relatively little is known (i.e. pre-phase III projects). For simplicity, we refer to early, pre-phase III developmental projects collectively as the ‘Hidden Pipeline’ To estimate the values of hidden pipelines as a percentage of share prices, we subtract from each company’s enterprise value an estimate of the present value of everything else – marketed products, products filed for regulatory approval, products in phase III development, and all non-pharma lines of business. On average, hidden pipelines account for more than a quarter of share prices, and the percentage of share price explained by hidden pipelines ranges from a low of 10, to a high of more than 50 percent (Exhibit 1 )  In theory, if the capital markets had equal amounts and qualities of information on these companies’ hidden and non-hidden operations, we would expect that knowing what’s in the hidden pipeline would take us roughly one-quarter to one-third of the way to explaining relative share price movements among these companies over time. However because the markets have substantially more information regarding non-hidden operations than they have regarding hidden pipelines, the valuations of hidden pipelines are much rougher guesses. By extension, this implies that the hidden pipeline valuations are inherently far more volatile than the valuations of non-hidden operations, and by further extension that hidden pipelines should explain substantially more than one-quarter of relative performance among these stocks Price versus Value … Having solved for the market capitalization of a company’s hidden pipeline, the question becomes whether or not the assigned market value reflects the hidden pipeline’s true economic value. To estimate pipelines’ true (relative) economic values, we rely heavily on patent data which, unlike traditional channels of disclosure, offer a reasonably consistent and complete[1] picture of hidden pipelines After assigning all active[2] patents to their corresponding parent companies, we take three key additional steps: 1) each patent is quality weighted[3]; 2) patents are segregated into those that correspond to either known (e.g. marketed, filed, or late stage projects) or hidden (pre-phase III) products / projects; and 3) each ‘hidden’ patent is assigned to disease, mechanism, and/or physical (chemical / biochemical characterization) categories[4]. The result is a company-by-company database that characterizes the sizes (numbers of quality-adjusted patents) and relative values (quality-adjusted patents, weighted further by the relative economic values of the disease areas in which the company conducts research) of the analyzed companies’ hidden pipelines To determine which companies’ pipelines appear relatively over- or undervalued, we simply compare the market capitalization (price) of each company’s hidden pipeline to the apparent (relative) economic value of that company’s hidden pipeline Exhibits 2 and 3 summarize the results. In Exhibit 2, column (b) provides our estimate of the market capitalization of the hidden pipeline[5], and for reference column (c) shows hidden pipeline capitalization as a percent of total enterprise value. Column (d) gives each company’s hidden pipeline value as a percent of the total hidden pipeline value for all companies. Using COMPANY X as an example, COMPANY X’s $20.3B hidden pipeline capitalization is about 2.8 percent of the $722B combined capitalization for all 22 companies’ hidden pipelines’. In column (e) we express the quality- and sales-weighted amount of innovation in each company’s hidden pipeline, as a percent of the total quality- and sales-weighted innovation in all 22 companies’ hidden pipelines. Here COMPANY X has 12.0 percent of the apparent innovation in the industry’s hidden pipeline. Column (f) is the ratio of columns e & d; i.e. column (f) is the share of peer group innovation in a given company’s hidden pipeline, divided by that company’s share of total peer group hidden pipeline market value (for COMPANY X we divide the company’s 12.0 percent share of industry hidden innovation by its 2.8 percent share of industry hidden valuation, for a ratio of 4.25). Companies with larger shares of innovation than of market value (e.g. COMPANY X) have hidden pipelines that are apparently undervalued, and vice versa[6]. Exhibit 3 depicts the data in Exhibit 2 graphically, comparing each company’s share of the peer group’s quality- and sales-adjusted hidden pipeline (y-axis), to its share of the total peer group’s hidden pipeline capitalization (x-axis). Companies that depart significantly from the 45 degree ‘normal’ have hidden pipelines that are apparently under- (above the normal line) or overvalued (below the normal line)

In theory, if the capital markets had equal amounts and qualities of information on these companies’ hidden and non-hidden operations, we would expect that knowing what’s in the hidden pipeline would take us roughly one-quarter to one-third of the way to explaining relative share price movements among these companies over time. However because the markets have substantially more information regarding non-hidden operations than they have regarding hidden pipelines, the valuations of hidden pipelines are much rougher guesses. By extension, this implies that the hidden pipeline valuations are inherently far more volatile than the valuations of non-hidden operations, and by further extension that hidden pipelines should explain substantially more than one-quarter of relative performance among these stocks Price versus Value … Having solved for the market capitalization of a company’s hidden pipeline, the question becomes whether or not the assigned market value reflects the hidden pipeline’s true economic value. To estimate pipelines’ true (relative) economic values, we rely heavily on patent data which, unlike traditional channels of disclosure, offer a reasonably consistent and complete[1] picture of hidden pipelines After assigning all active[2] patents to their corresponding parent companies, we take three key additional steps: 1) each patent is quality weighted[3]; 2) patents are segregated into those that correspond to either known (e.g. marketed, filed, or late stage projects) or hidden (pre-phase III) products / projects; and 3) each ‘hidden’ patent is assigned to disease, mechanism, and/or physical (chemical / biochemical characterization) categories[4]. The result is a company-by-company database that characterizes the sizes (numbers of quality-adjusted patents) and relative values (quality-adjusted patents, weighted further by the relative economic values of the disease areas in which the company conducts research) of the analyzed companies’ hidden pipelines To determine which companies’ pipelines appear relatively over- or undervalued, we simply compare the market capitalization (price) of each company’s hidden pipeline to the apparent (relative) economic value of that company’s hidden pipeline Exhibits 2 and 3 summarize the results. In Exhibit 2, column (b) provides our estimate of the market capitalization of the hidden pipeline[5], and for reference column (c) shows hidden pipeline capitalization as a percent of total enterprise value. Column (d) gives each company’s hidden pipeline value as a percent of the total hidden pipeline value for all companies. Using COMPANY X as an example, COMPANY X’s $20.3B hidden pipeline capitalization is about 2.8 percent of the $722B combined capitalization for all 22 companies’ hidden pipelines’. In column (e) we express the quality- and sales-weighted amount of innovation in each company’s hidden pipeline, as a percent of the total quality- and sales-weighted innovation in all 22 companies’ hidden pipelines. Here COMPANY X has 12.0 percent of the apparent innovation in the industry’s hidden pipeline. Column (f) is the ratio of columns e & d; i.e. column (f) is the share of peer group innovation in a given company’s hidden pipeline, divided by that company’s share of total peer group hidden pipeline market value (for COMPANY X we divide the company’s 12.0 percent share of industry hidden innovation by its 2.8 percent share of industry hidden valuation, for a ratio of 4.25). Companies with larger shares of innovation than of market value (e.g. COMPANY X) have hidden pipelines that are apparently undervalued, and vice versa[6]. Exhibit 3 depicts the data in Exhibit 2 graphically, comparing each company’s share of the peer group’s quality- and sales-adjusted hidden pipeline (y-axis), to its share of the total peer group’s hidden pipeline capitalization (x-axis). Companies that depart significantly from the 45 degree ‘normal’ have hidden pipelines that are apparently under- (above the normal line) or overvalued (below the normal line)

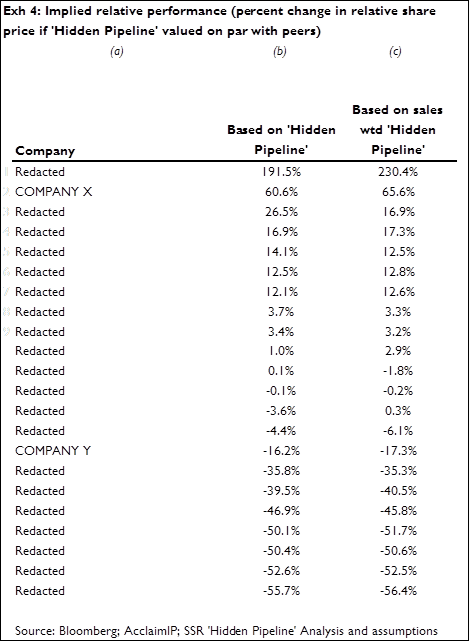

(Redacted) have hidden pipelines that appear undervalued[7]; (redacted) have hidden pipelines that appear overvalued[8] Implied performance, and actual performance to date Implied performance is simply the percentage change in relative share price that would bring a given company’s hidden pipeline valuation to par. Fundamentally, the idea is that a given hidden pipeline, adjusted for the sales potential reflected in its therapeutic area mix and the quality-adjusted volume of total innovation, should have nearly the same economic value[9] as an ‘average’ pipeline with the same therapeutic area mix, and quality-adjusted volume of innovation Results are provided in Exhibit 4, both with and without sales weighting of hidden pipeline values. Using COMPANY X as an example, based only on the amount and quality of innovation in COMPANY X’s hidden pipeline, and assuming only that this amount and quality of innovation ultimately is valued at par with other ‘Hidden Pipelines’ of comparable amounts and quality of innovation, we would expect COMPANY X to outperform its peers by roughly 61 percent. If in addition, we adjust our estimate of the value of COMPANY X’s hidden pipeline to account for the mix of therapeutic areas COMPANY X is pursuing, we would expect COMPANY X to outperform its peers by roughly 66 percent. Conversely if COMPANY Y’s hidden pipeline were valued at par, we would expect COMPANY Y to underperform by roughly 16 percent (ignoring therapeutic area mix) or, adjusting for the therapeutic area mix of COMPANY Y’s pipeline we would expect underperformance v. peers of roughly 17 percent

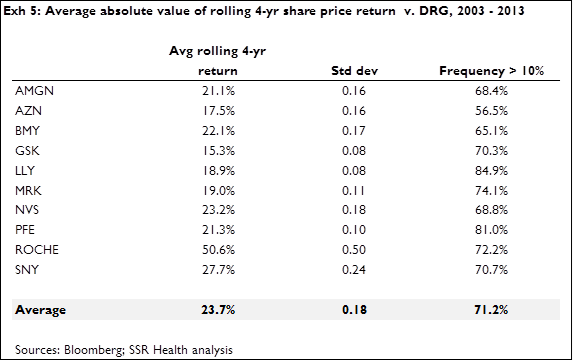

Because of the time necessary for ‘Hidden Pipelines’ to mature into tangible projects about which the market has sufficient information to efficiently assign values, we believe the misvaluations associated with companies’ ‘Hidden Pipelines’ should resolve gradually over roughly 4 years. We note that the average implied relative performance for the large-cap pharma names in Exhibit 4 is roughly 15 percent, and that this implied relative performance is comparable to the 24 percent average relative (rolling 4-yr) performance of these names over the last decade (Exhibit 5). This is consistent with, though does not prove, our assertion that hidden pipeline misvaluations have the potential to explain a very large percentage of the relative share price movements across the larger drug and biotechnology names

Exhibit 6 provides the actual relative performance of a drug / biotech portfolio whose stock selection is based entirely on hidden pipeline valuation (all names with ≥ 20 percent implied share price gain are held long). Performance figures are provided for the entire period since we first published the method (Nov 2012) and for each interval between updates. Since inception, returns to stocks chosen based on hidden pipeline valuations are roughly 1.56x peer group returns (1.47x equally weighted; 1.64x cap weighted)